3.1 Market Research

Section Three: Market Research

3.1 Key Information

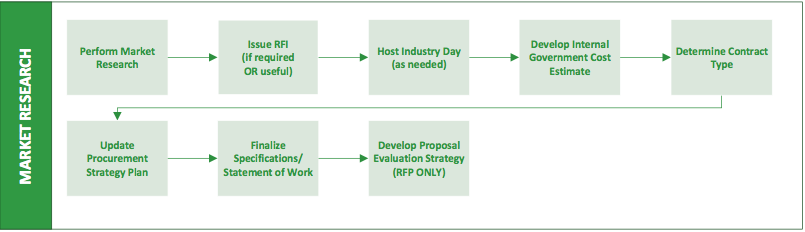

3.1.1 Market Research Phase Process Flow

The market research phase of the procurement lifecycle is defined as the process of defining the specific need and determining the most appropriate acquisition method for a procurement. The market research phase is arguably the most important phase of the procurement lifecycle in that it is where the research is performed, the vast majority of major decisions are made about the procurement, and where the key components necessary to manage the contract after award are incorporated prior to solicitation.

The following are the major steps in the process flow for the market research phase:

3.2 Perform Market Research

Once the Procurement Officer has completed the initial Procurement Strategy Plan in collaboration with the Procurement Team, the process of market research should begin. Market research refers to examining available sources of information to find available goods, services, construction and sources of supply, which may meet identified critical business requirements. The level of effort put into market research should be commensurate with the size and complexity of the procurement.

In preparation of a solicitation, the Procurement Team should consider the following factors:

- Is funding available? What is the project budget?

- Is the good, service, or construction currently under contract, either at an agency or state level?

- Who are the major vendors that tend to supply the goods, services, or construction?

- Is there a meaningful choice of supply in the market?

- How do local peers contract for the goods, services, or construction?

- How do other states contract for the goods, services, or construction?

- What is the estimated cost/price other agencies/States have paid for goods, services and construction similar in scope and magnitude to your procurement?

While an exhaustive review of sources of supply may not be feasible or practical, the goal of market research is to identify a variety of potential sources of supply. By identifying the potential sources of supply, the Procurement Officer and Procurement Team are able to analyze various goods, services, and construction offerings. Studying various offerings is essential to developing a solicitation that is not biased in favor of a single source of supply or otherwise reducing the pool of suppliers capable of meeting the state’s critical business requirements.

Although the Procurement Team may have knowledge of certain specific goods, services, or suppliers, the Procurement Officer should not rely exclusively on stakeholders’ knowledge. Instead, the Procurement Officer must actively engage in market research by accessing informational resources such as the Internet, industry organizations, consultant reviews, advertisements, cooperative procurement entities, or industrial publications. The Procurement Officer should also consult with other public entity Procurement Officers with similar purchasing needs, both within and outside of Hawaii.

As potential sources of supply are identified, the Procurement Officer may contact potential suppliers directly to request information. The Procurement Officer’s contact with potential suppliers may occur informally, such as by telephone or email. The Procurement Officer may determine a more formal method of gathering information from suppliers, such as the Request for Information discussed below.

3.3 Request For Information (RFI)

A Request for Information (RFI) is a method for requesting information from suppliers who have knowledge or information about an industry, goods, services, or construction. The Procurement Officer should use the RFI method when it is considered impractical to initially prepare a definitive purchase description, when informal discussions with vendors are not productive, or it is required by statute, HRS 103F.((The Request for Information discussed in this section should not be confused with the mandatory Request for Information required in purchases of Health and Human Services under HRS 103F and HAR 3-142.)) The RFI process for HRS 103F procurements is discussed in Section 4.6.

The RFI method is not a competitive solicitation method and, as a result, does not satisfy the requirement for competitive bidding. The RFI method is no more than an information gathering tool, and such information gathered may or may not be used by the state agency to develop a competitive solicitation.

The RFI should detail the objective of the procurement and include, but not be limited to:

- A description of the information requested of vendors;

- A method for receiving the requested information;

- A statement that the response is to provide the purchasing agency with recommendations that will serve to accomplish the work required by the procurement;

- A statement that the purchasing agency reserves the right to incorporate in a solicitation, if issued, any recommendations presented in the response to the request for information; and

- A statement that neither the purchasing agency nor the supplier responding has any obligation under the request for information.

If the Procurement Team has developed an initial specification or statement of work, it can provide this in the RFI and ask that vendors validate the requirements and provide feedback and comments that will help the State reach its procurement objectives.

While an RFI can be useful, it should only be used when truly seeking input from the vendor community for the solicitation. If the Procurement Team does not intend to incorporate the information and/or feedback it receives then it should not utilize the RFI method. Also Procurement Teams are strongly cautioned against using an RFI as a method to restrict future competition on the resulting solicitation. This can occur when in the team incorporates only the proposed delivery model or other unique features of a single bidder in the final scope or specifications. Vendors are not required to respond to an RFI and a vendor’s failure to respond to an RFI will not prohibit the vendor from responding to any competitive solicitation that may result from the RFI.

3.4 Industry Day

An agency may consider holding an industry day event in order to present its plans for a current or future procurements and seek input concerning current industry practices related to the requirement from members of the vendor or contractor community. An industry day is usually held prior to the release of an RFP. It is an opportunity for the agency to provide the vendor community with a detailed overview of its procurement requirements and solicit feedback about the procurement. Various methods for hosting these meetings may be offered, such as webinars, video conferences, telephone conferences, or other methods.

Industry days are particularly useful when an agency has a complex program or project where multiple contracts of varying scope and magnitude will be required to complete the project. Industry day goals include:

- Ensuring collaboration between the agency program office and vendors

- Incorporating vendor comments into the RFP development process

- Communicating program requirements and schedule

- Gaining a better understanding of recent industry or market developments

- Providing updates to vendors on future program developments and procurements

- Providing a forum for contractors to network with potential subcontractors, subconsultants, and/or the small business community for upcoming procurements.

3.5 Internal Government Estimate

In the market research phase the Contract Administrator, working with the Procurement Team, should take the time to develop an internal government estimate for the anticipated cost of the requirement. The internal estimate must be independent from the offeror’s proposal, which is why this estimate is often called an Independent Government Estimate. Independent development is vital because this estimate normally provides your first indication of a reasonable contract price and it is also one of the bases that you should consider in contract price analysis. The estimate development process may be automated or manual, but the best estimates reflect the findings from the market research. Section 4.7.2 covers elements of cost or price analysis to establish the estimated cost of the requirement. For in-depth guidance on developing your internal estimate, refer to our Basic Pricing Guide, Chapters 2 and 3 on Independent Government Estimates.